Exploring the Metaverse: Top 10 Crypto Trends

The metaverse has gained significant traction in recent years, becoming a hot topic in the crypto industry. As technology continues to advance, the concept of a virtual reality space where users can interact and transact with each other using digital currencies has become a distinct possibility. In this article, we will delve into the top 10 crypto trends shaping the metaverse.

1. Decentralized Finance (DeFi)

DeFi has revolutionized the traditional financial system by eliminating intermediaries and providing users with more control over their assets. In the metaverse, DeFi protocols enable users to access financial services, such as lending, borrowing, and trading, directly within the virtual environment.

2. Non-Fungible Tokens (NFTs)

NFTs have taken the art and collectibles world by storm, and their integration into the metaverse is inevitable. These unique digital assets can represent ownership of virtual lands, virtual items, and even virtual identities, making them an essential part of the metaverse economy.

3. Gaming and Virtual Real Estate

Gaming has long been associated with virtual reality, and the metaverse offers a vast playground for gamers. From virtual worlds to virtual real estate, players can create, sell, and trade virtual assets, blurring the lines between the digital and physical realms.

4. Blockchain Interoperability

Blockchain interoperability is crucial for the seamless integration of different blockchain networks within the metaverse. Cross-chain communication and interoperability protocols enable users to transact with various cryptocurrencies and assets across different virtual environments.

5. Social Tokens

Social tokens allow creators, influencers, and communities to monetize their online presence. In the metaverse, social tokens can be used for access to exclusive content, virtual events, or even virtual meetups, fostering a vibrant and engaging virtual social ecosystem.

6. Virtual Reality Marketplaces

Virtual reality marketplaces serve as the bridge between the physical and virtual worlds, allowing users to buy and sell virtual assets. These marketplaces provide a platform for creators to showcase and monetize their virtual creations, making the metaverse a thriving economy.

7. Security and Privacy

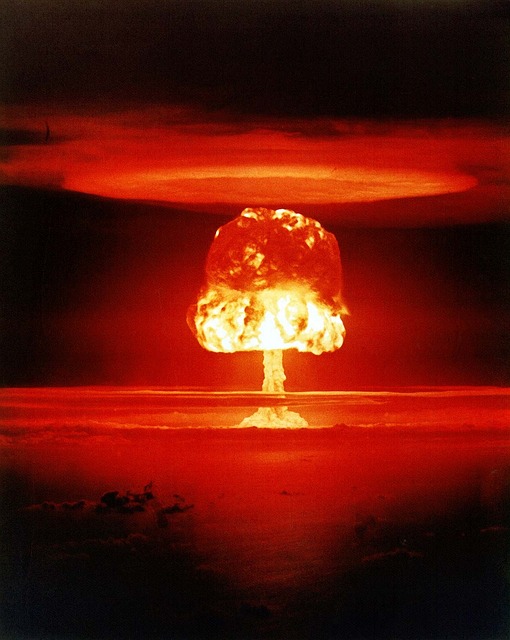

With the rise of virtual assets and digital currencies, ensuring security and privacy within the metaverse has become paramount. Crypto risks, such as hacking and theft, pose challenges that need to be addressed to safeguard users' assets and personal information.

8. Cross-Platform Accessibility

For the metaverse to reach its full potential, it must be accessible across various platforms and devices. Whether using virtual reality headsets, smartphones, or computers, users should be able to seamlessly access and navigate the metaverse.

9. Governance and DAOs

Decentralized Autonomous Organizations (DAOs) enable the community to govern and make collective decisions regarding the metaverse's development and operations. These decentralized governance structures ensure that the metaverse remains a democratic and inclusive space.

10. Education and Collaboration

The metaverse has immense potential for educational purposes and collaboration. Virtual classrooms, conferences, workshops, and collaborative workspaces can foster global connections and enrich learning experiences.

Crypto Risks: Ensuring Secure Digital Currency Storage

Digital currency storage plays a crucial role in safeguarding assets from potential threats. As the value and popularity of cryptocurrencies continue to grow, securing these digital assets becomes paramount. This article will explore various crypto risks and discuss strategies to ensure secure storage.

1. Hardware Wallets

Hardware wallets offer a high level of security by keeping the private keys offline, away from potential online threats. These physical devices are designed to secure digital currencies and provide users with full control over their assets.

2. Multi-Signature Wallets

Multi-signature wallets require multiple private key holders to authorize transactions, providing an added layer of security. This ensures that a single compromised key cannot lead to unauthorized access to the funds.

3. Cold Storage

Cold storage refers to storing digital assets offline, making them inaccessible to online threats. This can be achieved through hardware wallets, paper wallets, or even offline computers dedicated solely to storing cryptocurrencies.

4. Two-Factor Authentication (2FA)

Enabling two-factor authentication adds an extra layer of security to online accounts. By requiring an additional verification step, such as a code sent to a user's mobile device, the risk of unauthorized access is significantly reduced.

5. Regular Software Updates

Keeping software wallets and applications up to date is essential to prevent vulnerabilities that can be exploited by hackers. Developers often release patches and security updates to address any identified issues.

247 Crypto Trade Login

247 Crypto Trade is a popular platform that provides users with access to a wide range of crypto trading opportunities. This article will guide you through the login process and ensure seamless access to your trading account.

1. Visit the Official Website

To log in to 247 Crypto Trade, start by visiting the official website. Ensure that you are accessing the correct web address to avoid phishing attempts or fraudulent websites.

2. Enter Your Credentials

In the login section of the website, enter your registered email address or username and your password. Make sure you enter the correct information to avoid any login issues.

3. Complete Two-Factor Authentication (2FA)

247 Crypto Trade employs two-factor authentication (2FA) to enhance the security of user accounts. After entering your credentials, you may be prompted to provide a verification code, typically received through email or SMS.

4. Access Your Account

Once you have successfully entered your credentials and completed the authentication process, you will be granted access to your 247 Crypto Trade account. Now you can explore the platform's features and begin trading cryptocurrencies.

Crypto Arena Security

Crypto Arena is a prominent cryptocurrency trading platform that prioritizes the security of user funds and sensitive information. This article will discuss the various security measures employed by Crypto Arena to ensure a safe trading environment.

1. Secure Socket Layer (SSL) Encryption

Crypto Arena utilizes SSL encryption to protect user data and communications. SSL encrypts the information exchanged between users and the platform, making it virtually impossible for hackers to intercept and decipher.

2. Cold Storage for Funds

User funds on Crypto Arena are stored in cold wallets, offline and disconnected from the internet. By using cold storage, the risk of online attacks and theft is significantly minimized.

3. Regular Security Audits

Crypto Arena conducts regular security audits to identify and address any vulnerabilities in its systems. These audits help ensure that the platform remains up to date with the latest security standards and practices.

4. Two-Factor Authentication (2FA)

Enabling two-factor authentication adds an additional layer of security to user accounts. Crypto Arena encourages users to enable 2FA to protect their accounts from unauthorized access.

5. Account Activity Monitoring

By monitoring account activity, Crypto Arena can detect and respond to any suspicious or unauthorized actions promptly. This enhances the platform's security and protects user accounts from potential threats.

Tectonic Crypto Burn Rate

The crypto industry is evolving at an unprecedented pace, with new projects and cryptocurrencies emerging regularly. The Tectonic Crypto Burn Rate examines the rate at which cryptocurrencies are being permanently removed from circulation. This article will delve into the significance and implications of the Tectonic Crypto Burn Rate.

1. Scarce Supply and Increased Value

The Tectonic Crypto Burn Rate reduces the overall supply of a particular cryptocurrency, increasing its scarcity. As the supply decreases, the demand may remain constant or even increase, potentially leading to a rise in the value of the cryptocurrency.

2. Tokenomics and Economic Stability

Implementing a Tectonic Crypto Burn Rate allows projects to fine-tune their tokenomics and achieve greater economic stability. By reducing the circulating supply, projects can better manage the token's inflation rate and maintain a healthy balance between supply and demand.

3. Investor Incentives

A Tectonic Crypto Burn Rate can provide incentives for investors to hold a particular cryptocurrency. By permanently removing tokens from circulation, the project implicitly rewards long-term supporters and creates a sense of scarcity that can drive up the token's value.

4. Environmental Considerations

Some crypto projects choose to implement a Tectonic Crypto Burn Rate as a method of reducing their environmental impact. By removing tokens from circulation, the energy consumption associated with mining or validating transactions can be reduced.

5. Implications for Future Development

The Tectonic Crypto Burn Rate can significantly impact a project's future development and direction. By carefully managing the burn rate, projects can create a foundation for sustained growth and long-term viability.