Exploring Software Trading in Crypto and Crypto Trading Bots in Australia

With the rising popularity of cryptocurrency trading, the demand for software trading tools and trading bots has seen an exponential increase. For Australian traders, navigating this digital landscape can be both exciting and daunting. In this blog post, we will discuss the intricacies of software trading in crypto, the effectiveness of crypto trading bots, and the unique factors that affect trading in Australia. By the end of this article, you should have a comprehensive understanding of how to leverage these tools and strategies for optimal trading success.

Understanding Software Trading in Crypto

Software trading refers to the use of specialized programs and applications to facilitate trading activities. This can range from simple market analysis tools to complex algorithms that automate trading processes.

What is Software Trading?

In essence, software trading encompasses any tool that enables traders to analyze market data, execute trades, and manage their portfolios. These tools can be standalone applications or integrated within larger trading platforms and are designed to simplify and enhance the trading experience.

- Market Analysis Tools: These provide real-time data and analytics to help traders make informed decisions.

- Automated Trading Systems: Algorithms that execute trades based on predefined criteria, removing human emotion from the trading process.

- Portfolio Management Software: Allows traders to track their investments and assess their performance over time.

Benefits of Using Software Trading Tools

Investing in software trading tools can significantly enhance your trading strategy. Here are some reasons:

- Efficiency: Automated systems can execute trades faster than a human can, capturing more profitable opportunities.

- Data Analysis: Advanced analytics tools can identify trends and patterns, facilitating better decision-making.

- Emotionless Trading: Bots operate on logic rather than emotions, which can often lead to better trading outcomes.

Crypto Trading Bots in Australia

The use of crypto trading bots has grown significantly, and Australia is no exception. These bots are designed to automate trading activities, allowing for 24/7 trading without the trader having to be physically present. But how effective are they?

What are Crypto Trading Bots?

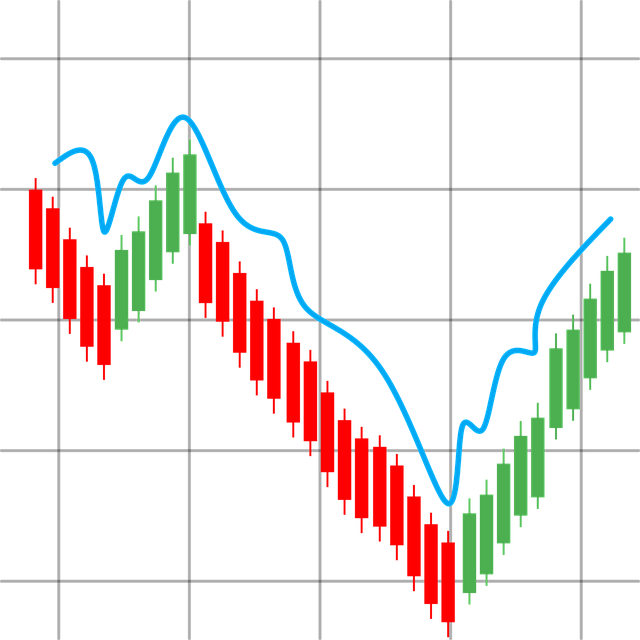

Crypto trading bots are software applications that use algorithms to analyze market conditions and execute buy or sell orders based on market data. They can be configured to follow specific strategies, enabling traders to capitalize on price movements without manual intervention.

Popular Types of Crypto Trading Bots

- Market-Making Bots: Provide liquidity to exchanges, profiting from the spread between buy and sell orders.

- Arbitrage Bots: Exploit price differences between exchanges by buying low on one and selling high on another.

- Trend Following Bots: Analyze market trends to identify trading opportunities based on historical data.

How Effective are Crypto Trading Bots?

The effectiveness of crypto trading bots can vary greatly depending on several factors:

- Market Conditions: Bots perform optimally under stable market conditions where trends can be easily identified.

- Strategy Configuration: The success of a trading bot relies heavily on the strategies it is programmed to follow.

- Risk Management: Even the best bot cannot predict market volatility; thus, having a strong risk management strategy is vital.

Navigating the Crypto Trading Scene in Australia

Understanding the Regulatory Landscape

Australia has established a regulatory framework for cryptocurrency trading, governed mainly by the Australian Securities and Investments Commission (ASIC). Traders are encouraged to stay informed on policy changes as regulations can impact trading opportunities.

The Best Platforms for Trading Crypto Bots in Australia

Choosing the right trading platform is crucial for successful trading in Australia. Some notable platforms include:

- Binance: Offers a wide range of cryptocurrencies and advanced trading features.

- CoinSpot: An Australian exchange praised for its user-friendly interface.

- eToro: Known for its social trading capabilities that let users mimic the trades of successful investors.

Tips for Using Crypto Trading Bots Effectively

- Start Small: Begin with a small investment to understand the bot's performance.

- Monitor Performance: Regularly review your bot’s trades to ensure it’s functioning as desired.

- Update and Optimize: Continuous optimization of your trading bot is essential to adapt to changing market conditions.

Resources for Becoming a Pro Trader

How to Become a Certified Crypto Trader in 2024

To navigate the complexities of crypto trading, it may be beneficial to pursue a certification program. How to Become a Certified Crypto Trader in 2024 provides valuable insights and guidelines for aspiring crypto traders. Certification can establish credibility and equip you with the knowledge needed to excel.

Understanding Trading Timing

Timing plays a crucial role in trading strategies. For instance, Best Time to Trade Crypto in Nigeria: Insights for 2024 delves into optimal trading times that can maximize profitability. While the timing in Nigeria specifically is discussed, many insights can be generalized to the Australian market as well.

The Value of Crypto Signals

Importance of Crypto Signals

Crypto signals serve as valuable tools in the trading arena. These signals provide traders with alerts about potential buying or selling opportunities. A detailed look into these can be found in Crypto Signals Free: A Deep Dive into Their Value, Sources, and Impact. This resource highlights the different sources of crypto signals and their potential impact on trading success.

Daily Crypto Signals

For traders looking to maximize their potential, utilizing daily crypto signals can be a game-changer. Daily Crypto Signals: Maximizing Your Trading Potential explores strategies on effectively integrating these signals into your trading strategy, providing a structured approach to trading.

Future Trends in Crypto Trading

The Rise of AI in Trading

Artificial intelligence is transforming how trading is conducted. The article The Best Crypto AI Trading Bots of 2024: Revolutionizing the Future of Trading discusses the top AI trading bots for the upcoming year. Automated tools are becoming increasingly sophisticated, allowing traders to analyze data and execute trades more efficiently.

Exploring Exchange Listing Bots

As the crypto landscape evolves, so does the technology that underpins it. The Future of Trading: Crypto Exchange Listing Bots and AI-Driven Crypto Bots highlights how exchange listing bots can help traders capitalize on new cryptocurrency listings and effectively manage their trading strategies.

Conclusion

To sum up, the world of crypto trading is rapidly evolving, and the integration of software trading tools and crypto trading bots is transforming the landscape for Australian traders. While the road ahead may have uncertainties, being equipped with the right tools, continuous learning, and adaptive strategies will certainly enhance your trading experience.

As a reminder, always approach crypto trading with caution and ensure to stay informed about the latest trends and regulations.