Ethereum - A Promising Option

Conferences feature renowned speakers who share their expertise and insights on various aspects of the cryptocurrency market. These educational sessions help attendees gain a deeper understanding of the industry, including blockchain technology, investment strategies, and regulatory developments.

Discovering New Opportunities

Litecoin, often referred to as the silver to Bitcoin's gold, has emerged as a popular alternative cryptocurrency to mine. It offers faster transaction times and a different mining algorithm than Bitcoin. This makes Litecoin mining more accessible to enthusiasts with standard computer hardware.

Ripple - Efficient and Secure

Several factors influence the liquidity of a cryptocurrency:

- Market Capitalization: Higher market capitalization generally indicates increased liquidity.

- Trading Volume: A higher trading volume suggests better liquidity.

- Exchange Listings: Cryptocurrencies listed on multiple major exchanges tend to have higher liquidity.

- Regulation: Regulatory clarity and acceptance can enhance liquidity.

The Importance of Crypto Business Conferences

Ethereum is another prominent cryptocurrency that offers exciting opportunities for miners. Its blockchain technology enables the development of smart contracts and decentralized applications. With its growing community and market capitalization, Ethereum mining can be a profitable venture.

Litecoin - The Silver to Bitcoin's Gold

Cryptocurrency mining has become a popular way for individuals to earn digital assets. With numerous cryptocurrencies available, choosing the best one to mine can be a daunting task. In this article, we will explore some of the top cryptocurrencies to mine and their potential benefits.

Bitcoin - The Pioneer

Ripple is a unique cryptocurrency that focuses on facilitating fast and low-cost international money transfers. Unlike Bitcoin and Ethereum, Ripple does not require mining. All Ripple coins are pre-mined, making it an efficient and secure option for investors and users.

Is Crypto a Liquid Asset?

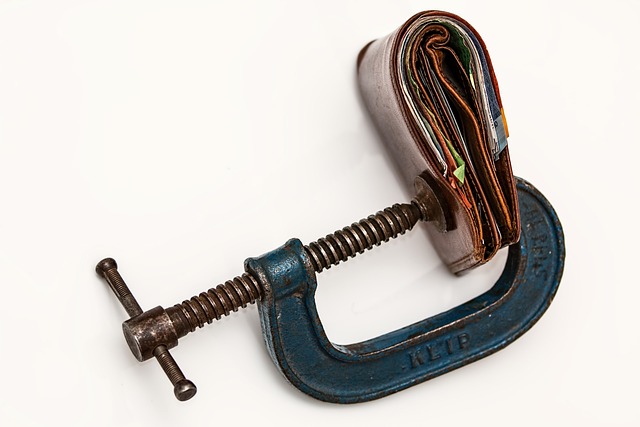

As more individuals and businesses embrace cryptocurrencies, the question of whether crypto is a liquid asset arises. Liquidity refers to an asset's ability to be quickly bought or sold without significantly impacting its price. In the crypto world, liquidity can vary depending on the specific cryptocurrency.

Factors Affecting Crypto Liquidity

Crowdfunding Crypto: A Revolution in Digital Currency

In conclusion, mining cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple can provide exciting opportunities for individuals. It is important to research and choose the best option based on factors such as mining difficulty, potential profitability, and personal preferences. Additionally, staying informed through articles like "Crowdfunding Crypto: A Revolution in Digital Currency," understanding liquidity as explained in "Is Crypto a Liquid Asset?," and recognizing the importance of attending crypto business conferences like "The Importance of Crypto Business Conferences" can enhance one's knowledge and involvement in the ever-evolving crypto world.

Crypto conferences bring together professionals and individuals from various sectors of the industry. Attending these events provides valuable networking opportunities and the chance to establish meaningful connections for potential collaborations and partnerships.

Education and Insights

Crypto business conferences often showcase innovative projects and startups. Attending these events allows participants to discover new investment opportunities and stay updated on emerging trends that could shape the future of the industry.

Crypto business conferences play a vital role in the development and growth of the cryptocurrency industry. These events provide a platform for industry experts, enthusiasts, and investors to connect, share knowledge, and discuss the latest trends and innovations. Here are several reasons why attending crypto business conferences is essential: