Environmental Impact of Crypto Mining

3arrows Crypto also offers educational resources and research materials for users to enhance their knowledge of the cryptocurrency market. This empowers users to make well-informed investment decisions.

Conclusion

When a transaction is made using a cryptocurrency, it needs to be confirmed by miners. Miners compete to solve the mathematical puzzle associated with the transaction and the first one to solve it gets rewarded.

3arrows Crypto is a platform that offers a wide range of services for cryptocurrency enthusiasts. It provides solutions for trading, investing, and managing digital assets.

Advanced Trading Tools

To learn more about 3arrows Crypto and its offerings, you can read the full article here.

Portugal Crypto Tax: Everything You Need to Know

Crypto mining refers to the process of validating and verifying transactions on a blockchain network. It involves solving complex mathematical problems to add new blocks to the blockchain.

How Does Crypto Mining Work?

Individuals and businesses involved in cryptocurrency-related activities must report their transactions to Portugal's tax authorities. Failure to comply with reporting requirements can result in penalties.

Tax Deductions and Benefits

The platform provides portfolio management tools for users to effectively manage their digital assets. Users can track their investments, analyze performance, and make informed decisions.

Education and Research

Miners play a crucial role in maintaining the security and integrity of the blockchain network. Their computational power ensures that transactions are valid and that no double-spending occurs.

Types of Crypto Mining

Proof of Work (PoW)

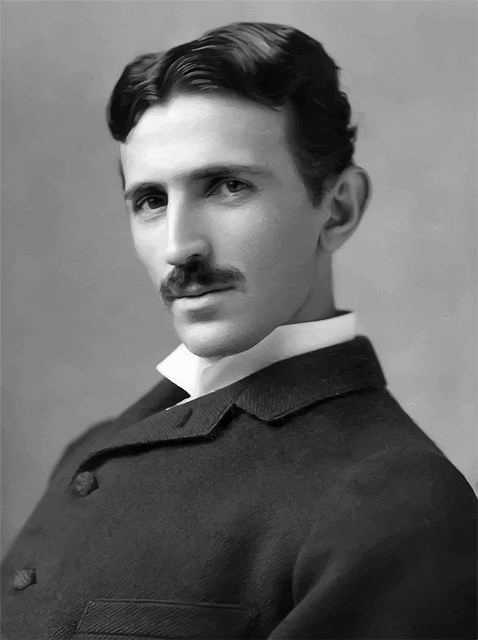

3arrows Crypto is making waves in the world of digital currencies. In this article, we will explore how this platform is revolutionizing the digital currency landscape.

Introduction to 3arrows Crypto

Income generated from cryptocurrency transactions, such as trading, mining, and staking, is subject to taxation. The tax rate varies depending on the type of activity and the individual's tax bracket.

Reporting Requirements

Crypto mining is a fundamental process that ensures the security and integrity of blockchain networks. It involves solving complex mathematical problems and plays a vital role in the world of digital currencies.

The Basics of Crypto Mining: How It Works

Portugal offers certain tax deductions and benefits for businesses and individuals involved in cryptocurrency activities. These deductions can help reduce the overall tax liability.

Getting Professional Advice

3arrows Crypto is revolutionizing the digital currency landscape by providing a comprehensive platform for trading, investing, and managing digital assets. It prioritizes security, offers advanced tools, and focuses on user education.

Proof of Work is the most common mining algorithm used by cryptocurrencies like Bitcoin. Miners solve mathematical problems to validate transactions and add them to the blockchain.

Proof of Stake (PoS)

Given the complex nature of cryptocurrency taxation, it is advisable to seek professional advice from tax experts or accountants specialized in this field.

Conclusion

The platform offers advanced trading tools for experienced traders. These tools include real-time market data, charting and analysis tools, and automated trading strategies.

Security and Privacy

The miners use specialized hardware and software to perform complex calculations. These calculations require a significant amount of computational power.

The Role of Miners

Understanding Portugal's tax regulations regarding cryptocurrencies is crucial for individuals and businesses. Compliance with the tax requirements ensures a smooth and legal operation within the country.

To learn more about Portugal crypto tax and its implications, you can refer to the detailed article here.

3arrows Crypto prioritizes the security and privacy of its users. It implements strict security measures to protect user funds and sensitive information.

Portfolio Management

Understanding the tax regulations surrounding cryptocurrencies is essential for individuals and businesses in Portugal. In this article, we will discuss everything you need to know about Portugal crypto tax.

Legal Status of Cryptocurrencies in Portugal

In Portugal, cryptocurrencies are considered a taxable asset. They are subject to capital gains tax and must be reported to the tax authorities.

Taxation of Cryptocurrency Transactions

Crypto mining has faced criticism for its high energy consumption. The specialized hardware and computational power required for mining contribute to significant electricity consumption.

Conclusion

Crypto mining is an essential process in the world of digital currencies. In this article, we will explore the fundamentals of crypto mining and how it works.

What is Crypto Mining?

To learn more about the basics of crypto mining, you can check out the article here.