Crypto Mining Taxes 2021: Understanding the Tax Implications of Cryptocurrency Mining

Cryptocurrency mining has become increasingly popular as more individuals and businesses seek to profit from digital currencies. However, it is essential to understand the tax implications of crypto mining to ensure compliance with tax laws and regulations.

1. What is Crypto Mining?

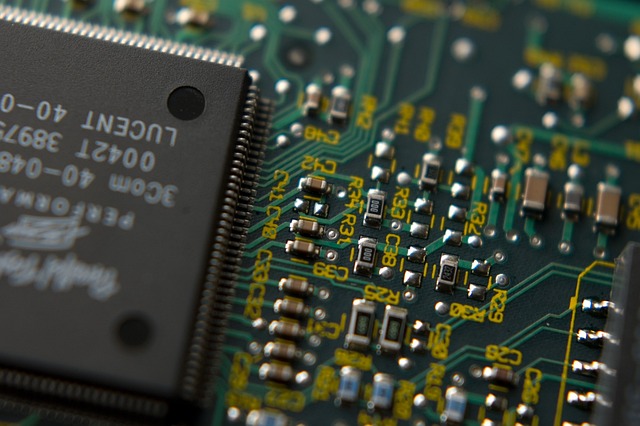

Crypto mining is the process of validating and verifying transactions on a blockchain network, such as Bitcoin or Ethereum, through solving complex mathematical problems. Miners use specialized hardware to perform these computations and are rewarded with newly minted cryptocurrencies as compensation.

Crypto Risks: Ensuring Secure Digital Currency Storage

2. Taxable Income from Mining

When it comes to taxation, the IRS treats mined cryptocurrencies as taxable income. The fair market value of the mined coins at the time of receipt is considered income and must be reported on your tax return.

Crypto Trading Bot Python: Automate Your Trading Strategy

H3. Determining the Value of Mined Coins

To determine the value of mined coins, you should use the fair market value in US dollars at the time of receipt. This can be calculated based on the exchange rate on a reputable cryptocurrency exchange.

H3. Reporting Mined Coins

You need to report the mined coins as taxable income using the appropriate tax forms, such as Schedule C (for self-employed individuals) or Form 1040 (for individuals). Failure to report mined coins can result in penalties and potential legal consequences.

3. Deductible Expenses

While mining income is taxable, you can also deduct certain expenses associated with mining activities. These may include:

Keep detailed records of your expenses to substantiate your deductions and consult a tax professional to ensure you meet the requirements.

4. Different Mining Methods

There are different mining methods, including:

Each method has its own tax implications, and it is crucial to understand the tax rules specific to the mining method you choose.

5. Consult a Tax Professional

Given the complex nature of cryptocurrency taxes, it is highly recommended to consult a tax professional experienced in this area. They can help you navigate the tax implications of crypto mining and ensure compliance with the latest tax laws.

Can you make money with cryptocurrency?

Crypto Index Funds: A Beginner's Guide to Vanguard

Ensuring Secure Digital Currency Storage: The Importance of USDT Crypto

By understanding the tax implications of crypto mining and seeking professional advice, you can ensure compliance with tax regulations while maximizing your mining profits.