Crypto Auto Trading Robots: The Future of Cryptocurrency Trading

Author: Jameson Richman Expert

Published On: 2024-12-15

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

The world of cryptocurrency trading has evolved dramatically over the last few years. With the introduction of sophisticated technologies, traders now have the opportunity to automate their trading experience. One of the most significant advancements in this arena is the use of crypto auto trading robots. In this article, we will explore what these robots are, how they work, their advantages and disadvantages, and the specific case of Crypto Clamp Robotics Capital.

What are Crypto Auto Trading Robots?

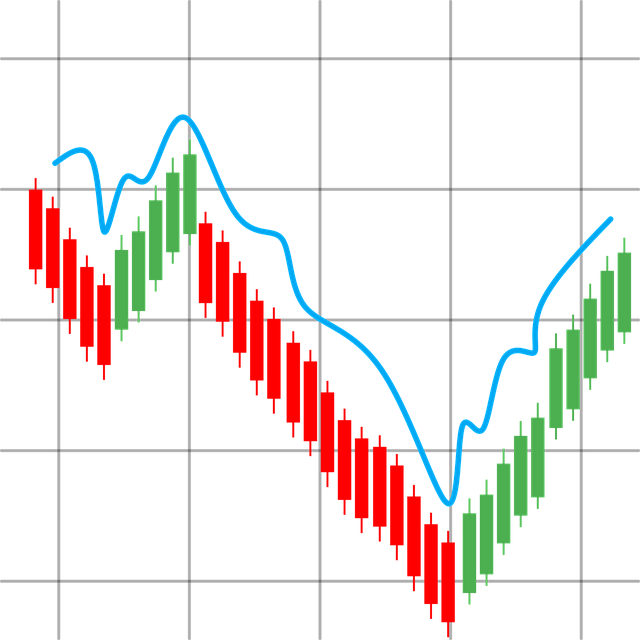

Crypto auto trading robots, also known as trading bots, utilize algorithms to execute trades on behalf of users. They analyze market data, identify profitable trading opportunities, and automatically execute trades based on pre-defined strategies. These robots can operate 24/7, eliminating the need for users to continually monitor the markets.

How Do Crypto Auto Trading Robots Work?

At their core, trading bots use complex algorithms that can process vast amounts of market data. Here’s how they generally work:

- Data Analysis: The robot collects and analyzes market data from various exchanges to identify trends.

- Strategy Implementation: Users can define the trading strategies they wish to implement (e.g., scalping, day trading, etc.).

- Trade Execution: Once the parameters are set, the bot executes trades automatically when conditions are met.

- Monitoring and Adjustment: Some bots also monitor their performance and adjust strategies as necessary.

Types of Crypto Trading Bots

There are several types of crypto trading bots, each designed for different trading strategies:

- Market Making Bots: Help to provide liquidity by placing buy and sell orders on both sides of the order book.

- Arbitrage Bots: Take advantage of price discrepancies across different exchanges.

- Trend Following Bots: Trade based on the direction of market trends.

- Portfolio Automation Bots: Manage your crypto portfolio by automatically rebalancing assets.

Advantages of Crypto Auto Trading Robots

The use of crypto auto trading robots comes with several advantages:

1. 24/7 Trading

Unlike traditional trading, bots can operate around the clock, allowing traders to capitalize on opportunities at any time without needing to be present.

2. Emotionless Trading

One of the most significant benefits of automated trading is the elimination of human emotions. Bots operate based on data and algorithms, removing the psychological factor that often leads to poor trading decisions.

3. Speed and Efficiency

These robots can execute trades at speeds far beyond human capabilities. This speed is crucial in a highly volatile market like cryptocurrency.

4. Automation of Strategies

Users can automate multiple strategies simultaneously, allowing them to diversify and spread their capital across various trades without the need for constant supervision.

Disadvantages of Crypto Auto Trading Robots

While trading bots offer numerous benefits, they are not without their drawbacks:

1. Risk of Malfunction

Errors in coding and various market irregularities could potentially cause a bot to malfunction and incur significant losses.

2. Over-Reliance on Technology

Some traders may become overly reliant on bots, neglecting their understanding of market dynamics.

3. Costs

High-quality bots often come with subscription fees or a percentage of profits, which can reduce overall earnings.

Exploring Crypto Clamp Robotics Capital

Among the various trading bots available in the market, Crypto Clamp Robotics Capital has emerged as a notable player. This platform claims to utilize cutting-edge algorithms combined with machine learning to optimize trading outcomes.

Features of Crypto Clamp Robotics Capital

Here are some of the key features that Crypto Clamp Robotics Capital offers:

- User-Friendly Interface: The platform is designed to be accessible for both beginners and experienced traders, with easy navigation and straightforward settings.

- Strategy Customization: Users can create and customize their trading strategies based on their risk tolerance and market analysis.

- Real-Time Analytics: The platform provides real-time data and analytics to help traders make informed decisions.

- Security Features: Crypto Clamp emphasizes security, employing advanced encryption methods to protect users’ data and funds.

User Experience

Users of Crypto Clamp Robotics Capital have reported varying experiences. Many appreciate the functionality and ease of use, while others caution about risk management when deploying the bot's strategies. It is crucial for traders to do their due diligence before engaging with automated systems.

Final Thoughts on Crypto Auto Trading Robots

The rise of crypto auto trading robots is a testament to the rapid evolution within the cryptocurrency market. While these bots offer numerous advantages, such as 24/7 trading and the elimination of emotional decision-making, they also come with risks that cannot be ignored. It’s essential for traders to understand how these systems work and to maintain a degree of caution when relying on them.

In conclusion, whether you decide to use a trading bot like Crypto Clamp Robotics Capital or not, the most important factor is to pair technological tools with a solid understanding of market dynamics. Only then can traders hope to navigate the complex world of cryptocurrency successfully.