Creating Binance Python Trading Bots: A Thorough Examination

Author: Jameson Richman Expert

Published On: 2024-09-11

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

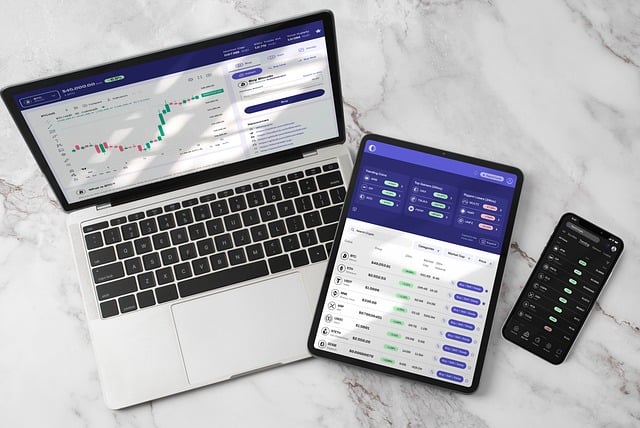

The world of cryptocurrency trading is rapidly evolving, characterized by its volatility and the innovation of trading technology. Among these technologies, trading bots have gained tremendous popularity, especially in platforms like Binance. In this comprehensive article, we will dive deep into the workings and advantages of utilizing a Binance Python trading bot, explore its functionalities, and help you navigate through the coding intricacies involved in creating your own bot. We will also highlight various resources and guides that can help you better understand the workings of trading bots in the cryptocurrency space.

What is a Binance Python Trading Bot?

A Binance Python trading bot is a software application programmed to execute trades on Binance, one of the largest cryptocurrency exchanges in the world, using Python as the programming language. These bots can automate trading according to defined strategies, allowing traders to operate day and night without manual intervention. Now more than ever, these bots have become essential tools for both casual and serious traders seeking an edge in the competitive crypto market.

The Need for Automation in Crypto Trading

Automation in trading is crucial due to various factors, such as the continuous nature of the cryptocurrency market. Unlike traditional stock markets that function within specific hours, cryptocurrencies can be traded 24/7. As a result, investors often face significant challenges in managing their trades, necessitating the use of bots.

Furthermore, the crypto market's extreme volatility can make it challenging for traders to make decisions swiftly. Trading bots can respond to market changes in real-time, allowing for better risk management and improved trading efficiency. **This is a gameChanger for both newcomers and seasoned traders who aim to optimize their trading practices!**

Getting Started: Building Your Own Binance Python Trading Bot

1. Prerequisites

Before we delve into the coding aspect, it is essential to have a strong foundation in Python programming and a rudimentary understanding of how the Binance API works. Our link to Unlocking the Secrets of Trading Bots: Your Comprehensive Guide goes in-depth about the various types of trading bots available, how to select the right one, and the ethical considerations associated with automated trading. This resource is invaluable for traders interested in understanding the broader implications of using bots.

2. Setting Up the Environment

To begin building a Binance trading bot with Python, you need an environment set up with Python and specific libraries. Here are the steps:

- Install Python from the official Python website.

- Install the necessary libraries using pip:

pip install requestsfor making API requests.pip install python-binancefor interfacing with Binance API.

3. Creating API Keys

Next, you will need to create an API key on Binance. Navigate to your account settings on Binance and generate a new API key. This key is essential for interacting with the Binance API securely. Make sure to restrict the permissions based on what your bot needs, such as viewing and executing trades.

4. Coding Your Bot

Here's an example of how to start building a simple trading bot:

from binance.client import Client

# Binance API key and secret

API_KEY = 'YOUR_API_KEY'

API_SECRET = 'YOUR_API_SECRET'

client = Client(API_KEY, API_SECRET)

# Example: Get the current price of Bitcoin

btc_price = client.get_symbol_ticker(symbol="BTCUSDT")

print(f"The current Bitcoin price is: {btc_price['price']}")

This code initializes the Binance client and fetches the current Bitcoin price. As you advance, you can include more sophisticated trading strategies based on technical indicators, market trends, and historical data analysis.

Strategies for Developing Your Trading Bot

1. Trend Following

One popular strategy is the trend-following strategy, which involves buying an asset when its price is increasing and selling it when its price is decreasing. This strategy can be implemented efficiently with a Binance Python trading bot. You can leverage various indicators such as moving averages or Relative Strength Index (RSI) to determine market trends.

2. Arbitrage Bots

Arbitrage trading entails exploiting price differences across different exchanges. Bots can monitor these discrepancies in real-time and execute trades almost instantaneously. Although this method requires significant capital and fast execution, the earnings can be substantial.

3. Market Making

Market makers provide liquidity to the market by placing buy and sell orders. By systematically placing these orders, bots can profit from the price spread. This technique is more advanced and suitable for experienced traders who are well-versed in market dynamics.

Tools and Resources for Trading Bots

Several resources can enhance your trading bot development experience. These include:

1. Trading with Binance: A Comprehensive Guide

For those new to Binance, our resource on Trading with Binance: A Comprehensive Guide offers essential insights into placing manual orders, understanding different order types, and getting acquainted with the Binance interface. A solid understanding of the platform will enhance your skill in creating effective bots.

2. Libraries and Frameworks

In addition to the python-binance library, there are several other frameworks like CCXT and Backtrader that can facilitate the development and backtesting of trading bots. Integrating these libraries can provide robust functionalities and streamline the algorithm development process.

3. Community and Forums

Participating in trading forums or communities can also provide invaluable insights. Engaging with others can expose you to different strategies and coding techniques that can significantly enhance your bot’s effectiveness.

The Future of Trading Bots

Revolutionizing Trading

The advancements in machine learning and artificial intelligence are further revolutionizing trading bots. Insights from our article on Revolutionizing Trading: The Rise of Crypto Bots in Financial Markets explore how these technologies enable bots to learn from past trading behavior and optimize future trading strategies accordingly. **The evolution of trading bots is paving the way for a new era in investment strategies, fundamentally altering how individuals approach trading!**

Binance-Specific Bot Development

When focusing specifically on Binance, our article Revolutionizing Trading: The Rise of Trading Bots for Binance delves deeper into features unique to the Binance platform that can make your bot even more efficient. It discusses exploitational strategies that specifically take advantage of Binance’s trading features.

Advanced Trading Tools: 3Commas

For those looking for an all-in-one trading solution, “3Commas: The Ultimate Trading Companion for Cryptocurrency Enthusiasts” showcases how to use 3Commas to automate your trades without extensive programming knowledge. It allows users to create smart trading bots with minimal effort.

Looking Ahead: Altsignals

Future trends in the industry are explored in the piece titled Altsignals: Navigating the Future of Cryptocurrency Trading. As more traders explore alternative trading signal platforms, there’s a fascinating opportunity for trading bots to integrate with these insights, allowing for even greater trading sophistication.

Conclusion

In conclusion, building a Binance Python trading bot can significantly elevate your trading experience and efficiency in the increasingly crowded cryptocurrency markets. As automation continues to redefine the landscape of trading, understanding the tools and techniques at your disposal can provide you with a competitive edge. If you take the time to research, understand market dynamics, and skillfully implement your strategies, a trading bot can become an invaluable asset in your trading toolkit. **Perhaps the most crucial thing is not just to meet the demands of the market, but to stay one step ahead!**