Bot Trading on Binance: A Comprehensive Exploration

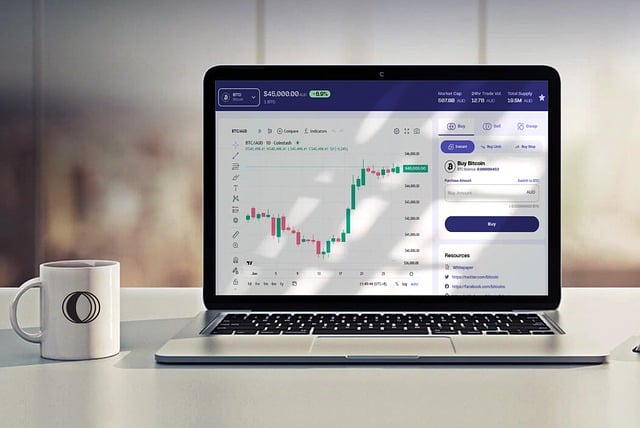

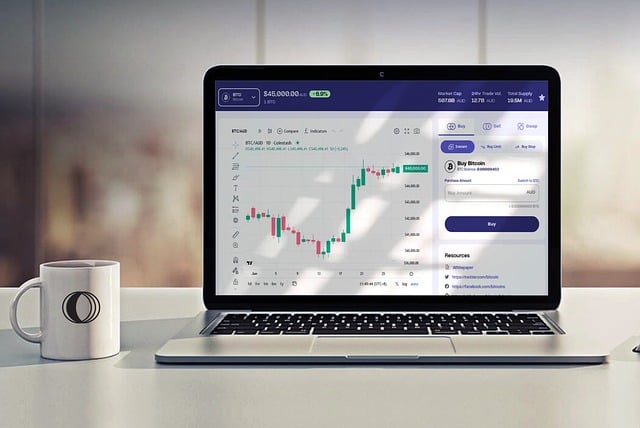

The evolution of cryptocurrency trading has been a remarkable journey, marked by the rise of automation and technological advancements that empower traders to operate more efficiently. Among these advancements is the practice of bot trading on platforms like Binance. In this article, we’ll explore the nuances of bot trading, its advantages, potential pitfalls, and valuable resources to enhance your trading strategy. Together, we'll navigate through a landscape that is both challenging and exciting.

Understanding Bot Trading

Bot trading refers to the use of software programs (trading bots) that execute trades on behalf of the user. These bots can monitor the market 24/7, analyze data, and execute trades based on predefined criteria. Here are some core concepts related to bot trading:

Key Terms in Bot Trading

- Algorithm: A set of rules or calculations to follow when making trading decisions.

- API (Application Programming Interface): A method for connecting software applications, allowing trading bots to interact with blockchain platforms like Binance.

- Backtesting: The process of testing the bot's performance using historical data before going live.

- Slippage: The difference between expected and actual trade prices, which can impact profitability.

Advantages of Using Trading Bots

One of the main attractions of bot trading is the elimination of emotional biases that human traders often face. Bots can execute trades based on logical calculations rather than gut feelings. This removes the stress associated with manual trading and can lead to more consistent results.

- Consistency: Bots can maintain a trading schedule unaffected by stress, fatigue, or emotional dilemmas.

- Speed: Trading bots can analyze data and execute trades within milliseconds, enabling users to take advantage of price movements in real time.

- Diversification: A single trader can manage multiple markets or assets simultaneously, increasing potential revenue streams.

Are There Any Downsides?

As promising as bot trading can be, it’s crucial to recognize its limitations. Not all trading strategies result in profit, and relying solely on a bot can flatten one’s understanding of market dynamics over time. Moreover, bots operate on algorithms that, while brilliant, cannot anticipate sudden market shifts due to unforeseen global events.

Getting Started with Binance Trading Bots

For those keen to dive into bot trading on Binance, selecting the right strategy and bot is essential. Several platforms offer sophisticated bots that integrate seamlessly with Binance. Here are important considerations when starting your journey:

Choosing the Right Bot

- Research: Understand the different types of bots available, such as arbitrage, market-making, or trend-following bots.

- Security: Ensure that the bot provider has robust security protocols to protect your assets.

- Compatibility: Check if the bot is designed to work specifically with Binance’s API.

Strategies to Deploy

Strategic planning is paramount. The choice of strategy can significantly impact outcomes. Common bot trading strategies include:

- Scalping: Taking advantage of small price changes for quick, frequent trades.

- Trend Following: Identifying and capitalizing on market trends.

- Mean Reversion: Trade based on the assumption that prices will revert to their historical mean.

Educational Resources for Enhanced Trading

To fine-tune your bot trading skills, seeking guidance from seasoned traders or educational resources can be invaluable. One such resource is A Comprehensive Guide to Crypto Bot Trading: Navigating the Future of Automated Cryptocurrency Investments. This article delves into how crypto bots change the landscape of trading, offering insights on strategy formulation and real-world applications.

Communication Tools in Trading: The Signals App

In the world of trading, effective communication is pivotal. The Signals App: A Comprehensive Guide to a Game-Changer in Secure Communication outlines why understanding communication tools can enhance your trading strategy. The app provides a secure platform for traders to discuss strategies, share insights, and maintain psychological profile assessments free from external manipulation.

Maximizing Profits: Expert Guides

Finally, embracing knowledge through expert guides can help traders unlock their full potential. The Ultimate Guide to Crypto Trade: Maximizing Profits in the Financial Markets delivers practical advice on structuring trades, understanding market trends, and utilizing bots effectively to enhance profitability.

Conclusion: The Future of Bot Trading on Binance

As we delve deeper into the realm of automation within cryptocurrency trading, one cannot ignore the vast potential that bot trading on platforms like Binance offers. While many grasp the fundamental concepts, succeeding in this space requires dedication, continuous learning, and adaptation to market changes.

Personally, I believe that as technology evolves, so too will our tools and approaches. Bot trading is not merely a trend; it’s a significant shift in how traders engage with the market. As such, investing time in understanding bots, their strategies, and effective trading communication will empower you to thrive in an increasingly automated trading landscape. Whether you’re a novice or an experienced trader, the information presented in the aforementioned resources can create pathways to achieving your trading goals.