Bitcoin AI: The Revolution of 2024

Author: Jameson Richman Expert

Published On: 2024-09-28

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

As we usher in 2024, the intersection of artificial intelligence (AI) and cryptocurrency, particularly Bitcoin, has sparked conversations and debates among technologists, investors, and financial analysts. In this article, we will delve into the advancements in Bitcoin AI, the implications for the market, and what the future holds for this dynamic fusion of technologies.

Understanding Bitcoin AI

Bitcoin AI refers to the application of artificial intelligence technologies specifically tailored to enhance Bitcoin trading, investment strategies, and overall market analysis. With the rapid evolution of machine learning algorithms and data analytics, AI is playing an increasingly significant role in creating smart trading strategies and risk management protocols.

The Rise of AI in Cryptocurrency

The adoption of AI has transformed various sectors, including finance, healthcare, and logistics. In the realm of cryptocurrency, AI's capabilities are particularly vital due to the highly volatile nature of digital currencies. Traders and investors are constantly searching for ways to gain an edge in this unpredictable market. As we progress through 2024, here are some pivotal ways AI is reshaping the Bitcoin landscape:

1. Automated Trading Systems

One of the most prominent applications of AI within Bitcoin is the development of automated trading systems. These algorithms leverage machine learning to analyze vast datasets, recognizing patterns and trends that human traders may overlook. Through historical data analysis, AI can devise trading strategies that optimize profits while minimizing losses.

- Machine Learning Models: These models are designed to adapt and improve over time, learning from past trades and market behavior.

- Real-Time Decision Making: AI algorithms can process information at lightning speed, allowing for immediate responses to market changes.

2. Predictive Analytics

Predictive analytics involves using AI to forecast future market trends based on historical data. In the Bitcoin market, where price shifts can be drastic and rapid, having the ability to predict potential movements is invaluable. By applying sophisticated algorithms, analysts can make informed predictions about future prices, enhancing investment strategies.

- Sentiment Analysis: AI can analyze social media trends and news sentiments, gauging public perception and potential market reactions.

- Price Forecasting Models: Enhanced models can sift through years of market data to suggest potential price points.

3. Portfolio Management

For investors managing multiple assets, AI offers tools for optimized portfolio management. By assessing the risk profiles of various assets and calculating the best allocation strategies, AI can help investors maximize returns while mitigating risks. This capability is particularly beneficial in a volatile market such as Bitcoin.

- Dynamic Rebalancing: AI systems can adjust portfolio holdings in real-time based on market changes and investment goals.

- Risk Assessment Tools: AI can analyze market conditions to inform investors when to hold or liquidate assets.

Impact on the Bitcoin Market

The integration of AI into Bitcoin trading has significant implications for the market as a whole. Here are several key impacts observed as of 2024:

Increased Market Efficiency

AI-enabled systems contribute to market efficiency by providing traders with tools that can swiftly analyze significant amounts of data. This efficiency often narrows the gap between buyers and sellers, resulting in more stable prices. AI can enhance liquidity by facilitating faster transactions and better price discoveries, ultimately promoting a healthier and more active market.

Greater Accessibility for Retail Investors

As AI-driven tools become more prevalent and user-friendly, more retail investors are empowered to participate in the Bitcoin market. Previously complex trading strategies can now be automated, enabling everyday investors to enter the cryptocurrency space with confidence. With user-friendly platforms, individuals without extensive financial knowledge can navigate the complexities of Bitcoin trading.

Risks and Ethical Considerations

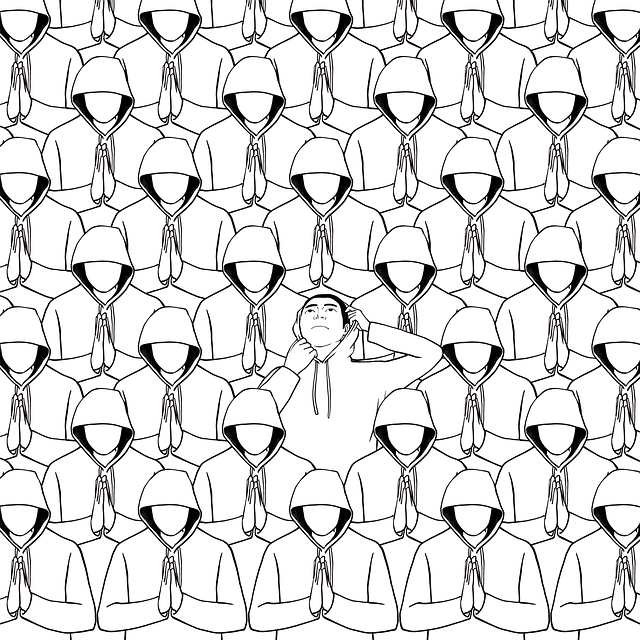

Despite the benefits, the rise of Bitcoin AI does not come without risks and ethical challenges. As AI systems gain greater influence over trading decisions, concerns around manipulation and market fairness are raised. Additionally, heavy reliance on algorithms may lead to systemic vulnerabilities.

- Market Manipulations: There’s potential for malicious actors to exploit AI-driven systems to create artificial price movements.

- Lack of Regulation: The rapid adoption of AI in trading often outpaces regulatory frameworks, raising concerns about consumer protection.

The Future of Bitcoin AI: Trends to Watch

As we move forward in 2024, several key trends are expected to shape the future of Bitcoin AI:

Integration of Blockchain with AI

The ongoing integration of blockchain technology with AI is poised to create novel solutions for the cryptocurrency market. By implementing AI algorithms on blockchain platforms, developers can enhance security measures, create decentralized applications, and improve transaction efficiency. This integration holds great promise for building robust systems that balance transparency with powerful analytical tools.

The Advancement of Decentralized Autonomous Organizations (DAOs)

DAOs are organizations run by computer programs and smart contracts rather than traditional management structures. By incorporating AI into DAOs focused on Bitcoin, we may see more optimized decision-making processes, allowing for more democratic and data-driven governance in the cryptocurrency space.

Stronger Focus on Ethical AI

As the influence of AI in cryptocurrency grows, so will the importance of ethical considerations. Stakeholders will increasingly prioritize the development of transparent and accountable AI systems that promote fair practices within the Bitcoin market. The push for ethical AI will likely initiate regulatory discussions and collaborative frameworks to ensure technology serves everyone's interests.

Increased Investment in AI Startups

Venture capitalists and major tech firms are expected to invest heavily in AI startups focused on cryptocurrency innovations. This infusion of capital will lead to the development of more advanced trading tools, analytics platforms, and security solutions that prioritize user experience and market integrity.

Conclusion: A Cautiously Optimistic Outlook

As we stand at the threshold of 2024, the convergence of Bitcoin and artificial intelligence offers both thrilling opportunities and significant challenges. The potential for AI to elevate trading efficiency, broaden accessibility, and enhance risk management practices is immense. However, we must also remain vigilant about the ethical implications and market risks that could accompany this technological evolution.

Ultimately, the future of Bitcoin AI hinges on our ability to strike a balance between innovation and responsibility. Transparent practices, regulatory diligence, and ongoing dialogues with stakeholders across industries will be essential to creating a crypto landscape where everyone can thrive. It is undoubtedly an exciting time for both AI and cryptocurrency enthusiasts, marking a pivotal moment in shaping the future financial ecosystem.