Unleashing the Future: A Deep Dive into Trading Bots

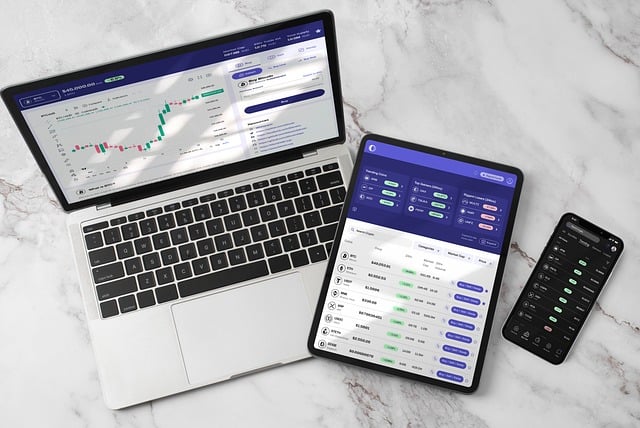

In the ever-evolving world of financial trading, technology continues to revolutionize how traders engage with markets. Among the most innovative tools emerging in recent years are trading bots—automated systems designed to execute trades on behalf of human users. These bots have not only enhanced trading efficiency but have also introduced new levels of strategy and analysis into both stock and cryptocurrency markets. This article will explore the capabilities of trading bots, their benefits and drawbacks, how they work, and much more.

Understanding Trading Bots

Trading bots, also known as algorithmic trading systems, are software applications that analyze market conditions and execute trades based on pre-defined rules and algorithms. They can operate on various financial instruments—including stocks, options, futures, and cryptocurrencies—at a speed and frequency that would be impossible for human traders. Essentially, trading bots serve as a bridge between human intuition and machine efficiency, allowing traders to capitalize on market opportunities in real-time.

The Mechanics Behind Trading Bots

At its core, a trading bot operates on a simple principle: utilizing algorithms to make trading decisions. Different bots employ various strategies, such as technical analysis, trend-following, arbitrage, market-making, and sentiment analysis.

How Trading Bots Operate

- Data Analysis: The bot collects and analyzes historical price data and other metrics.

- Signal Generation: Based on the analysis, the bot identifies potential entry and exit points for trades.

- Execution: When the predetermined conditions are met, the bot executes buy or sell orders automatically.

- Monitoring: Many bots continuously monitor positions, ready to adjust strategies based on market performance.

This automation allows traders to implement more complex strategies without the emotional biases that often plague manual trading.

Advantages of Using Trading Bots

There are several compelling reasons why traders are increasingly adopting bots:

- 24/7 Trading Capability: Bots can operate round the clock, taking advantage of opportunities in different time zones and market conditions.

- Elimination of Emotional Bias: Bots make decisions based purely on data and established rules, minimizing emotional trading decisions.

- Backtesting and Strategy Optimization: Traders can backtest their strategies against historical data to see how they might perform in live markets.

- Speed and Efficiency: Bots can execute trades in fractions of a second, often better than human capabilities.

Drawbacks and Risks of Trading Bots

While the benefits are significant, one must also consider the potential drawbacks associated with trading bots.

- Over-reliance on Automation: Traders may stop actively monitoring their strategies, leading to missed opportunities or amplified losses.

- Technical Failures: As with any software, bugs and glitches can occur, potentially resulting in catastrophic losses.

- Market Conditions: Bots work based on historical data, which may not always predict future market behavior accurately.

- Costs: Many reputable trading bots come with a price tag—either as a subscription model or through profit-sharing agreements.

Choosing the Right Trading Bot

With numerous trading bots available, selecting the right one entails understanding your trading goals, risk tolerance, and level of expertise. Below are some considerations when making this choice:

Criteria for Selection

- Reputation and Reviews: Always check user feedback and third-party reviews to gauge the bot's performance.

- Customizability: Depending on your trading strategy, you may want a bot that allows for modifications and customized algorithms.

- Customer Support: Good customer support can make a significant difference when you're trying to resolve issues or have questions.

- Security Protocols: Ensure that the bot uses robust security measures to protect your data and funds.

Popular Trading Bots to Consider

Some popular trading bots in the market include:

- 3Commas: Known for its user-friendly interface and powerful features, 3Commas offers various bots and trading strategies. For a more in-depth look, you can refer to The Comprehensive Guide to 3Commas Login: Unlocking Your Crypto Trading Potential.

- Cryptohopper: This platform enables traders to customize their bots and optimize their trading strategies based on market data.

- TradeSanta: A cloud-based bot that allows users to automate trading strategies without needing to download software.

- Bitsgap: A comprehensive platform offering various features, including arbitrage and portfolio management.

In my opinion, 3Commas stands out for both beginners and seasoned traders due to its comprehensive features, ease of use, and dedication to user satisfaction.

The Future of Trading Bots

As we look to the future, the evolution of trading bots is closely tied to advancements in artificial intelligence (AI) and machine learning. These technologies will likely enhance the capabilities of trading bots, allowing them to make more informed decisions based on vast amounts of data.

The Rise of AI Trading Platforms

AI trading platforms are revolutionizing financial markets by enabling faster data processing and more advanced predictive algorithms. For more information on this groundbreaking approach, refer to The Rise of AI Trading Platforms: Revolutionizing Financial Markets.

Impacts on Market Strategies

As AI continues to evolve, traders will have access to increasingly sophisticated tools that can analyze patterns, automate trading, and provide real-time insights into market conditions. This could lead to a new era of automated trading strategies that are not only faster but also more effective.

Emerging Trends in Crypto Trading

The world of crypto trading is also witnessing a transformation with the introduction of new strategies and tools. To stay ahead, traders must adapt their methods and incorporate modern techniques.

Key Developments

For instance, using bots for crypto trading offers unique strategies compared to traditional finance. A detailed analysis of this trend can be found in The Evolution of Crypto Trading: New Strategies for Tomorrow.

- Layer 2 Solutions: They offer faster transactions with lower fees and can potentially improve trading performance.

- Decentralized Finance (DeFi): Trading strategies around DeFi are gaining traction, offering unique opportunities for yield farming and liquidity provision.

- This might demand a more sophisticated approach to risk management.

Understanding Market Signals

For crypto traders, understanding market signals is essential to optimize results. An excellent resource for this is Understanding Bitcoin Signals: A Comprehensive Guide, which offers insights into how to interpret market signals effectively.

Final Thoughts

In conclusion, trading bots represent a significant advancement in the trading landscape, providing both opportunities and challenges. Traders must approach these tools with a well-informed strategy, ensuring that they strike a balance between automation and active involvement in their trades. The evolution of trading bots, leveraging advancements in AI and machine learning, signals an exciting future for traders who are willing to adapt and innovate.

As we continue to explore this digital frontier, understanding the tools at our disposal—like trading bots—will empower traders to navigate the complexities of the market with greater confidence and success.