The Insider’s Guide to Crypto AI Trading Bots: Harnessing Technology for Investment Success

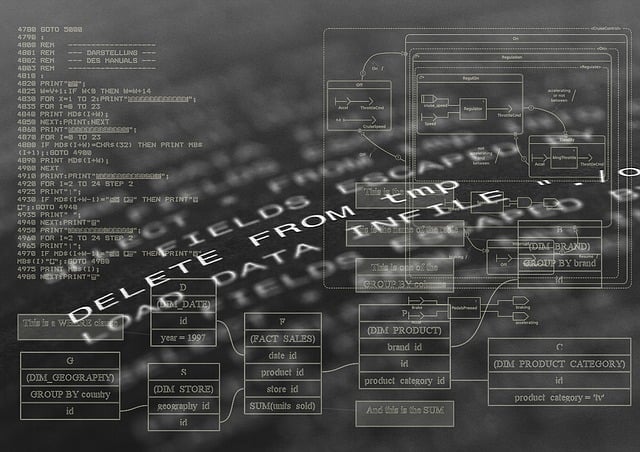

In the rapidly evolving world of cryptocurrency, one technological advancement has made a significant impact: the crypto AI trading bot. These automated tools are designed to analyze market data, execute trades, and enhance trading strategies by leveraging advanced algorithms and artificial intelligence. In this article, I will explore the dynamics of crypto AI trading bots, their advantages, challenges, and their future potential in the trading ecosystem.

Understanding Crypto AI Trading Bots

Before we dive into the intricacies of crypto AI trading bots, it is essential to grasp what they are and how they function. Essentially, a crypto AI trading bot is a software program that automates the trading process. By analyzing vast amounts of market data and employing machine learning algorithms, these bots can execute trades much faster than a human trader could.

How Do AI Trading Bots Work?

- Data Analysis: AI trading bots collect and analyze real-time market data, including price trends, trading volume, and news sentiment.

- Trading Strategy Development: Based on the insights gained from the data, these bots develop trading strategies designed to exploit market inefficiencies.

- Automated Execution: Once the bot identifies a lucrative trade opportunity, it can execute trades automatically, without human intervention.

In my personal opinion, the efficiency and speed of AI trading bots create opportunities that would be nearly impossible for human traders to capitalize on alone. These bots bring a systematic approach to trading, reducing the emotional biases that can lead to poor decision-making.

The Growing Popularity of Bot Crypto Trading

The interest in automated trading solutions has surged over the past few years. As investors seek more efficient ways to navigate the volatile crypto markets, the demand for crypto AI trading bots has undoubtedly increased. The comprehensive resource, The Growing Popularity of Bot Crypto Trading, highlights how more traders are embracing these bots to enhance their trading processes.

Why Are Traders Turning to Bots?

There are numerous reasons for the burgeoning interest in crypto trading bots:

- 24/7 Market Access: Unlike human traders, bots can operate continuously, capitalizing on markets that never close.

- Emotionless Trading: Bots eliminate emotional trading—an important factor since fear and greed can skew judgment.

- Backtesting Capabilities: Many bots offer features to backtest strategies against historical data, allowing traders to refine their approach before live trading.

The Rise of Trading Bots in the Crypto Market

The influx of trading bots has transformed how the crypto market functions. The article The Rise of Trading Bots in the Crypto Market discusses how these automated systems are reshaping market dynamics, providing individual traders with unprecedented access to trading strategies once reserved for larger institutional players.

Impacts of Trading Bots

The effects of trading bots on market volatility and liquidity can be profound. Bots can exacerbate price swings, leading to spikes or crashes, as algorithms react instantaneously to market movements. In my view, while trading bots enhance trading access, their unchecked use could also introduce substantial risks that might affect the market as a whole.

The Rise of Crypto Trading Bots: A Complete Guide

For anyone looking to understand how to implement trading bots in their investment strategy, The Rise of Crypto Trading Bots: A Complete Guide serves as a valuable resource. It outlines essential factors such as selecting the right bot, setting up trading parameters, and understanding risk management techniques.

Choosing the Right Bot

Not all trading bots are created equal. When selecting an AI trading bot, I recommend considering the following:

- Reputation and Reviews: Look for feedback from other users to gauge the bot’s reliability.

- Trading Strategies: Ensure the bot’s strategy aligns with your trading goals.

- Support and Community: A strong support network can be invaluable when questions arise.

Maximizing Your Trading Potential with 3commas: A Comprehensive Guide

Among the many trading platforms, 3commas has emerged as a popular choice for many traders. The Maximizing Your Trading Potential with 3commas: A Comprehensive Guide article provides extensive insights into how 3commas can empower traders through its advanced bot functionalities and user-friendly interface. This platform allows traders to strategize their trades, monitor performance, and optimize settings to suit their preferences.

Key Features of 3commas

One of the standout features of 3commas is its simplicity and control. The platform allows users to:

- Create Custom Trading Bots: Tailor bot features according to specific market conditions.

- Manage Risk: Utilize built-in tools to minimize potential losses through stop-loss and take-profit mechanisms.

- Follow Market Trends: Use insights and analytics to refine trading strategies based on evolving market conditions.

The Future of AI Crypto Trading: A Detailed Analysis

Looking ahead, the future of AI in crypto trading is exciting yet uncertain. As discussed in The Future of AI Crypto Trading: A Detailed Analysis, advancements in AI technology could lead to even more sophisticated trading bots that learn and adapt to market changes in real-time.

What's Next for Crypto Trading Bots?

I believe the next generation of AI trading bots will incorporate higher degrees of machine learning, enabling them to anticipate market changes rather than merely reacting to them. Such innovations could augment trading efficiency and profitability significantly. However, it's essential to remain cautious, as the more complex the systems become, the greater the potential for unforeseen outcomes.

Conclusion

Overall, crypto AI trading bots represent a revolutionary stride in the realm of automated trading. They offer promising opportunities for investors to optimize their strategies, especially in the notoriously volatile crypto market. However, I urge potential traders to approach them with a measured mindset, understanding both their capabilities and the associated risks. As the technology continues to evolve, staying informed and adapting strategies will be key to successfully harnessing the power of crypto AI trading bots.