2024: The Rise of Crypto Trading Bot Arbitrage

Author: Jameson Richman Expert

Published On: 2024-10-27

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

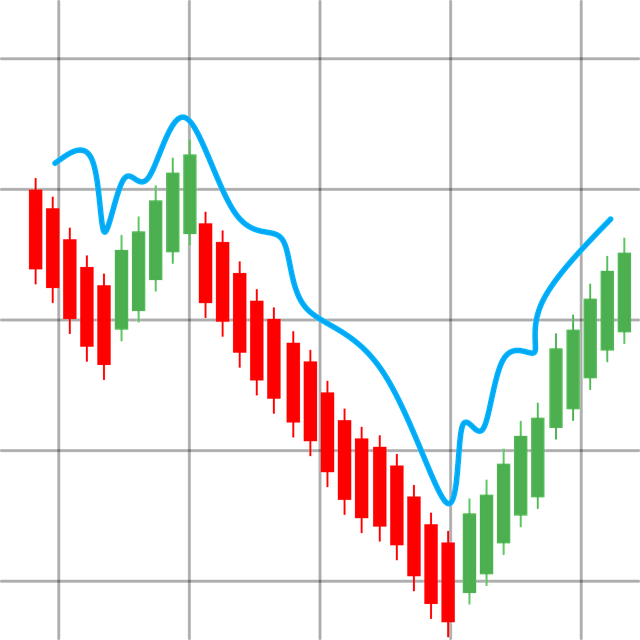

As we delve deeper into 2024, the cryptocurrency market continues to experience a dynamic transformation. Among the most exciting developments is the rise of crypto trading bot arbitrage, a strategy that has captured the attention of investors and traders alike. This article explores the intricacies of crypto trading bot arbitrage, its benefits, challenges, and future trends.

What is Crypto Trading Bot Arbitrage?

Crypto trading bot arbitrage refers to the automated process of exploiting price differences between various cryptocurrency exchanges. In essence, it allows traders to capitalize on the inefficiencies in the market by buying a cryptocurrency at a lower price on one exchange and simultaneously selling it at a higher price on another. This method can be executed faster and more efficiently with the aid of trading bots designed specifically for this purpose.

Understanding Arbitrage Opportunities

Arbitrage opportunities in the cryptocurrency market arise due to the decentralized nature of cryptocurrencies. Each exchange can have different pricing for the same asset due to variations in supply and demand, market sentiment, time zone differences, and other factors. For example, if Bitcoin is priced at $40,000 on Exchange A and $40,500 on Exchange B, a trader could buy on Exchange A and sell on Exchange B, securing a profit of $500 per Bitcoin before fees.

Types of Arbitrage

- Spatial Arbitrage: This is the most common form and involves taking advantage of price discrepancies between different exchanges.

- Temporal Arbitrage: This occurs when prices fluctuate over time. Traders look for opportunities to buy low, hold, and then sell high when the price increases.

- Statistical Arbitrage: This method involves complex algorithms and statistical models to predict price movements and identify potential profit opportunities.

How Crypto Trading Bots Work

Trading bots are software programs that automate trading activities. They utilize algorithms to analyze market data, execute trades, and manage portfolios with minimal human intervention. When it comes to arbitrage, these bots are programmed to monitor multiple exchanges continuously, identifying the best prices and executing trades in real-time.

The Key Features of Trading Bots

- Real-Time Data Analysis: Bots can process vast amounts of market data within seconds, identifying price discrepancies faster than human traders.

- Execution Speed: Trading bots can execute trades in milliseconds, which is crucial for arbitrage, as price discrepancies may only exist for a short duration.

- Automation: Once set up, trading bots reduce the need for constant monitoring, allowing traders to focus on strategy rather than day-to-day operations.

Advantages of Crypto Trading Bot Arbitrage

Enhancing Profit Margins

The primary advantage of crypto trading bot arbitrage is the potential for enhanced profit margins. By taking advantage of price differences, traders can secure profits that might be negligible if traded manually. This strategy can be particularly lucrative during periods of high volatility.

Reduced Emotional Stress

Trading can be emotionally taxing, especially in a volatile market like cryptocurrency. Trading bots eliminate the emotional aspect, as they execute trades based on pre-set parameters without being influenced by fear or greed.

Increased Accessibility

With automated trading bots, even novice traders can engage in arbitrage trading without needing extensive knowledge about the market. This encourages wider participation and democratizes trading opportunities.

Challenges of Crypto Trading Bot Arbitrage

Market Volatility

The cryptocurrency market is notorious for its volatility. While this can create arbitrage opportunities, it can also present risks. Prices may change rapidly, making it difficult for bots to execute profitable trades if they are not optimally configured.

Transaction Fees

Transaction fees can erode profits significantly in arbitrage trading. Each buy and sell order incurs fees, which must be accounted for when calculating potential profits. Traders need to ensure that the price differences are substantial enough to cover these costs.

Regulatory Concerns

As the cryptocurrency landscape evolves, regulatory scrutiny increases. Different jurisdictions have varying regulations regarding automated trading, which may impact the use of trading bots and the feasibility of arbitrage strategies.

Setting Up a Crypto Trading Bot for Arbitrage

Choosing the Right Trading Bot

When selecting a trading bot for arbitrage, traders should consider features such as compatibility with various exchanges, user interface, and supported trading strategies. Popular trading bots include:

- 3Commas: Supports multiple exchanges and offers a user-friendly interface.

- Gekko: An open-source trading bot that allows customization but requires some technical knowledge.

- HaasOnline: Known for its advanced features and extensive customization options.

Configuring the Bot

Once a trading bot is selected, the next step is configuration. This includes setting parameters for trading pairs, defining profit targets, and determining the maximum amount to invest in a single trade. It is crucial to ensure these settings are optimized to maximize profitability while mitigating risks.

Monitoring and Adjusting Strategies

Even with automation, continuous monitoring is essential. Traders should regularly review trading performance, make necessary adjustments, and stay updated with market conditions. Flexibility in strategy can often lead to better results in an ever-changing market.

The Future of Crypto Trading Bot Arbitrage

Emerging Technologies

As technology continues to advance, we can expect to see more sophisticated algorithms and AI integration in trading bots. These innovations may enhance the ability to predict market movements, identify arbitrage opportunities more efficiently, and improve overall trading performance.

Increased Market Maturity

As the cryptocurrency market matures, the number of participants increases, and more arbitrage opportunities may arise. However, competition may also intensify, which could reduce profit margins. Ultimately, successful traders will need to adapt and innovate continuously to stay ahead of the competition.

Broader Adoption of Crypto Trading Bots

In 2024, we may see an increase in the adoption of trading bots among retail investors and institutions. As more educational resources become available and the technology improves, participation in automated trading strategies will likely surge.

Conclusion: Seizing Opportunities in 2024

The year 2024 presents a unique opportunity for traders to engage in crypto trading bot arbitrage. By leveraging advanced technology, minimizing emotional stress, and increasing accessibility, traders can navigate the complex world of cryptocurrency efficiently.

However, it is essential to approach arbitrage trading with caution, recognizing the inherent risks and challenges. As always, thorough research and a well-defined strategy will prove to be invaluable assets in the quest for profitability.

As the crypto landscape continues to evolve, those who adapt quickly and intelligently to the market dynamics will emerge as the leaders of tomorrow. In 2024, the future of crypto trading bot arbitrage looks promising, offering exciting possibilities for both seasoned investors and newcomers to the world of cryptocurrency.