Are Forex Signals Real? An In-Depth Analysis of Their Authenticity and Effectiveness

Author: Jameson Richman Expert

Published On: 2025-09-30

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

The question "are forex signals real?" resonates deeply within the trading community, especially as the forex market’s complexity, liquidity, and volatility continue to grow exponentially. Forex signals—alerts or recommendations that advise traders on optimal entry and exit points—are often perceived as shortcuts to consistent profitability. These signals are generated from a blend of technical analysis, fundamental data, or sophisticated algorithms, and are promoted by analysts, automated systems, or signal services. As the allure of quick riches attracts more traders, the market sees a surge in dubious services claiming guaranteed success, making it essential to scrutinize their legitimacy critically. This comprehensive article aims to demystify the reality behind forex signals, evaluate their authenticity, and equip traders with guidelines to identify trustworthy sources from fraudulent schemes, thereby enhancing their trading strategies and risk management practices.

Understanding Forex Signals: Origins, Types, and Methodologies

Forex signals serve as a crucial communication bridge between complex market data and actionable trading decisions. They distill vast amounts of technical, fundamental, and sometimes sentiment data into concise recommendations aimed at guiding traders towards more informed entries and exits. To appreciate their reliability and potential, it is vital to understand how they originate and the underlying methodologies:

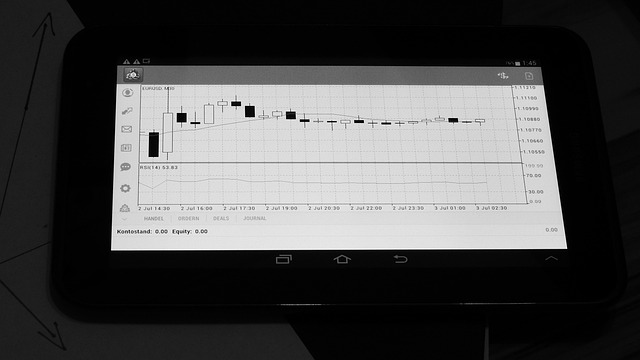

- Technical Analysis-Based Signals: This approach employs chart patterns and technical indicators to forecast future price movements. Popular tools include the Relative Strength Index (RSI), Moving Averages (MA), MACD (Moving Average Convergence Divergence), Bollinger Bands, Fibonacci retracements, and candlestick patterns. For example, a crossover of short-term and long-term moving averages might signal a trend change, prompting a buy or sell recommendation. These signals rely heavily on historical price action and often suit short- to medium-term trading.

- Fundamental Analysis-Based Signals: These are derived from macroeconomic indicators, geopolitical events, and monetary policy decisions. Key data points include GDP reports, employment figures, inflation rates, central bank rate changes, and political stability. For instance, a rate hike by a central bank could lead to a bullish signal for the local currency, prompting traders to go long on related currency pairs. Fundamental signals tend to have longer-term implications but can also trigger short-term volatility.

- Quantitative and Algorithmic Models: These involve sophisticated mathematical algorithms, machine learning models, or artificial intelligence systems analyzing large datasets, including news sentiment, order flow, and historical price patterns. These systems aim to identify subtle, often invisible, patterns and adapt dynamically to changing market conditions. For example, an AI model might detect emerging momentum or divergence signals that manual analysis could overlook, especially in high-frequency trading environments.

Some providers combine these methodologies to produce hybrid signals, enhancing their robustness. Each approach has its strengths and limitations—technical signals might lag actual market movements, fundamental signals can be delayed by data release schedules, and algorithmic signals require rigorous validation to avoid false positives. Recognizing the generation process enables traders to better gauge the reliability of the signals they receive and formulate risk-aware trading strategies. Importantly, traders should view signals as tools to inform their decisions—not as guaranteed predictions, since markets are inherently unpredictable and influenced by countless variables.

Are Forex Signals Legitimate? An Examination of Trustworthiness

The legitimacy of forex signals fundamentally depends on transparency, verifiable track records, and the ethical standards of the provider. Reputable signal services are typically operated by experienced traders, financial institutions, or recognized analysts who maintain transparency about their performance and methodology. Trustworthy providers often share real-time or historical trading results, disclose their analysis process, and follow ethical marketing practices.

In contrast, the forex market has unfortunately become a breeding ground for scams. Many unscrupulous providers employ high-pressure tactics, guarantee profits, or showcase manipulated performance data to lure inexperienced traders. Common scam indicators include:

- Claims of guaranteed profits or 100% success rates, which are impossible in the inherently risky trading environment.

- Fake testimonials, fake live trading accounts, or manipulated screenshots that falsely demonstrate consistent success.

- Lack of transparency regarding signal generation, no third-party verification, or refusal to share historical performance data.

- Aggressive marketing tactics emphasizing "get-rich-quick" promises, often coupled with high subscription fees.

Traders should always perform due diligence before subscribing to any signal service. Verifying the provider’s background, demand for transparency of past performance, and independent reviews is essential. Remember, no legitimate service can guarantee profits or success in every trade. The presence of such claims is a red flag indicating potential fraud or overhyped marketing tactics.

Criteria for Recognizing Reliable Forex Signal Providers

Choosing a dependable forex signal provider requires careful evaluation. Here are key criteria to consider:

- Verified and Audited Performance: Ideal providers publish independently audited trading results or verified trading accounts. Third-party audits add credibility by ensuring results are genuine and not manipulated.

- Transparency in Methodology: A trustworthy provider openly explains how signals are generated, whether manually or through automated algorithms. Clear risk management strategies, including stop-loss and take-profit settings, should be disclosed.

- User Feedback and Reputation: Check multiple independent review sites, forums, and social media channels for consistent positive feedback. Be skeptical of providers with numerous negative reviews or complaints about hidden fees or fake results.

- Trial and Demo Options: Reliable services often offer free trials, demo signals, or sample alerts, allowing traders to evaluate the accuracy and timing before committing real funds.

- Focus on Risk Management: The provider emphasizes responsible trading practices, such as setting appropriate stop-loss levels, position sizing, and trading within defined risk parameters.

- No Unrealistic Promises: Trust providers who avoid promises of guaranteed profits or "sure-win" signals. Instead, they focus on probabilistic trading strategies and risk mitigation.

Additional confidence can be gained from platforms integrated with reputable brokers that comply with regulatory standards, such as Binance or Bybit, which incorporate signal tools within their broader trading ecosystems, ensuring compliance and transparency.

Risks, Limitations, and Challenges Associated with Forex Signals

While forex signals can be valuable, traders must recognize their inherent risks and limitations:

- **Market Volatility and Unpredictability:** Sudden geopolitical developments, economic shocks, or unexpected central bank interventions can cause rapid price swings, rendering signals obsolete or invalid in real time. Even the most accurate signals cannot account for unforeseen events.

- **Signal Lag and Timing Issues:** Many signals are based on lagging indicators or historical data, which may not reflect the current market environment. In fast-moving markets, delays can lead to suboptimal entries or missed opportunities.

- **Overdependence and Complacency:** Relying solely on external signals without developing personal market understanding can diminish trading skills. During volatile periods, independent judgment and fundamental analysis become even more critical.

- **Fake or Manipulated Signals:** Unscrupulous providers may generate or manipulate signals to mislead traders, leading to potentially significant losses. Verification of signal sources and performance records is essential.

To mitigate these risks, traders should treat signals as supplementary tools, not infallible predictions. Combining signals with personal analysis, economic news, and technical insight enhances decision quality. Implementing strict risk management—such as stop-loss orders, proper position sizing, and diversification—is vital to protect capital, especially when market conditions shift unexpectedly.

Best Practices for Harnessing Forex Signals Effectively

Maximizing the benefits of forex signals involves adopting disciplined strategies and integrating signals into a comprehensive trading framework:

- Start Small and Test: Use demo accounts or small real trades to evaluate the accuracy, timing, and compatibility of signals before scaling up.

- Diversify Signal Sources: Rely on multiple reputable providers to reduce biases and increase decision robustness. Cross-verification helps filter out unreliable signals.

- Define and Stick to Risk Parameters: Always set stop-loss and take-profit levels aligned with your risk appetite. Avoid overleveraging or overtrading based solely on signals.

- Track and Analyze Performance: Maintain detailed logs of trades, success rates, and deviations. Use this data to refine your approach and identify the most reliable signals.

- Stay Informed on Market Events: Follow economic calendars, news outlets, and geopolitical updates to contextualize signals and anticipate market moves.

- Maintain Emotional Discipline: Resist impulsive decisions driven by hype, fear, or greed. Follow your trading plan strictly, especially during volatile episodes.

Trading platforms such as MEXC and Bitget provide integrated tools, educational resources, and community support to help traders implement disciplined, informed strategies that effectively incorporate signals into their trading routines.

Conclusion: Navigating the Truth About Forex Signals

The answer to "are forex signals real?" is nuanced. Genuine, transparent signal providers do exist and can be valuable tools within a disciplined trading strategy. However, the market is flooded with scams, false promises, and unverified services that can lead to severe financial losses. The key to success lies in conducting thorough due diligence, choosing reputable providers with transparent track records, and integrating signals into a comprehensive trading plan emphasizing risk management and continuous learning.

Ultimately, no external signal can guarantee profits. Your knowledge, emotional control, and adherence to a disciplined approach form the core of sustainable trading success. By approaching forex signals with skepticism, conducting rigorous research, and maintaining disciplined execution, traders can navigate the unpredictable forex markets more effectively and increase their chances of long-term profitability.