Are Forex Signals Illegal? An In-Depth Analysis

Author: Jameson Richman Expert

Published On: 2025-10-01

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Forex signals have experienced a significant surge in popularity among retail traders and institutional investors globally. These signals—comprising timely trading recommendations on entry and exit points—are designed to streamline decision-making, optimize trade timing, and potentially increase profitability. They can be delivered via multiple channels such as dedicated mobile applications, email alerts, social media platforms, or directly integrated into trading platforms through APIs or plugins. As the industry grows, so does scrutiny regarding their legal status, ethical considerations, and regulatory compliance. Are forex signals illegal? The answer is nuanced, heavily dependent on jurisdiction, provider transparency, licensing status, and marketing practices. Based on extensive analysis of various providers—from fully compliant firms to outright scams—I will explore the legal landscape in detail. Navigating this environment requires meticulous due diligence to avoid unintentional violations and protect your investment capital.

Understanding Forex Signals and Their Operational Mechanics

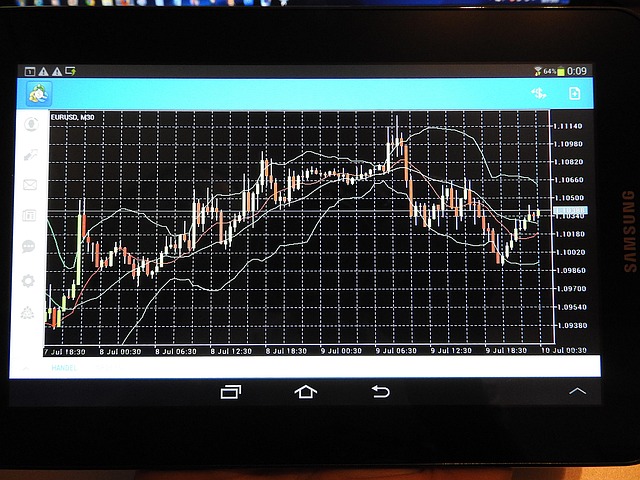

Forex signals are systematically generated trading recommendations that combine technical and fundamental analysis. They specify which currency pairs to trade, optimal entry and exit points, stop-loss levels, and take-profit targets. The analytical process behind signal creation employs sophisticated tools and methodologies:

- Technical analysis leveraging indicators such as Moving Averages, Relative Strength Index (RSI), Bollinger Bands, Fibonacci retracements, and chart pattern recognition algorithms.

- Fundamental analysis monitoring macroeconomic indicators including interest rate decisions, employment reports, GDP growth figures, geopolitical events, and central bank policies that influence currency valuations.

Signals are disseminated through various communication channels—proprietary apps, email newsletters, SMS alerts, social media posts, or integrated directly into trading platforms via APIs. Many providers claim to utilize proprietary algorithms or employ professional analysts to enhance accuracy. For novice traders, signals serve as a shortcut to market insights, reducing the need for complex technical charting or economic analysis. However, experienced traders often use signals as supplementary confirmation rather than sole decision-making tools, emphasizing the importance of understanding underlying market dynamics, personal risk management, and ongoing education.

It is vital to recognize that signals are tools—valuable when used responsibly—and are not infallible. Their success hinges on the quality of analysis, timely delivery, and appropriate position sizing. Integrating signals into a disciplined trading plan with predefined risk controls and continuous learning significantly improves the likelihood of sustainable trading success.

Legal Frameworks Governing Forex Signals

The legal status of providing or using forex signals varies significantly across jurisdictions. In countries such as the United States, members of the European Union, Canada, Australia, and the UK, offering financial signals is typically classified as a regulated activity akin to providing financial advisory or brokerage services. Regulatory bodies enforce licensing, advertising standards, and operational transparency to safeguard traders from fraud, misrepresentation, and unlicensed activity.

For example, in the US, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) oversee forex-related services, requiring providers to register, meet capital adequacy standards, and adhere to strict consumer protection rules. Similarly, the UK’s Financial Conduct Authority (FCA) mandates transparency, fair advertising, and comprehensive risk disclosures. The European Securities and Markets Authority (ESMA) enforces compliance among EU-based providers, emphasizing investor protection.

Regulated providers must disclose their analytical methodologies, produce verifiable performance histories, and avoid deceptive marketing. They are often mandated to maintain segregated client accounts, conduct regular audits, and publish independent performance reports. These regulatory standards aim to prevent scams, false advertising, and exploitative practices that harm traders.

In contrast, in countries with weak or nonexistent regulatory oversight—frequently emerging markets—the landscape is much riskier. Unlicensed operators may operate illegally, often promising guaranteed profits, manipulating performance data, or engaging in outright scams. Such entities pose substantial risks, including financial theft, market manipulation, or legal repercussions for traders.

Therefore, due diligence is essential: verify whether the provider holds valid licenses, complies with local laws, and maintains transparent operational practices. Watch out for red flags such as refusal to disclose analytical methods, exaggerated success claims, or inability to provide verifiable results—hallmarks of potential scams.

Risks and Pitfalls Associated with Forex Signal Providers

While forex signals can be advantageous, reliance on unverified or fraudulent providers introduces significant risks. Many scammers exploit trader naivety by claiming unrealistically high success rates, guaranteeing profits, or promoting “no-risk” strategies—claims that are inherently deceptive because forex trading inherently involves risk. No signal system or strategy can guarantee consistent profits, and excessive marketing hype often disguises underlying fraudulent intent.

Even legitimate providers face challenges. Market volatility, geopolitical upheaval, economic shocks, and unexpected news releases can invalidate signals or lead to unexpected losses—even when analysis is accurate. Relying solely on signals without understanding their basis, or neglecting risk management principles such as stop-loss placement and position sizing, can magnify losses. Past performance does not predict future results, and providers that showcase extraordinary returns should be viewed skeptically.

Misapplication of signals—such as trading with excessive leverage, ignoring stop-loss orders, or overtrading—amplifies risk exposure. The most prudent approach is to incorporate signals within a comprehensive trading plan emphasizing risk controls, diversification, and continuous education. Remember, no matter how reputable the provider, markets are inherently uncertain, and losses are part of trading.

Legally and Ethically Using Forex Signals

To remain compliant, traders should select signals from reputable, regulated providers. Many established brokers and analysis firms operate under strict regulatory oversight, adhering to licensing standards, providing transparent methodologies, and maintaining verifiable track records. Examples include platforms like Binance, Mexc, Bitget, and Bybit. These platforms maintain high regulatory standards and promote transparent analysis-based signals.

Additionally, traders should invest in ongoing education—learning fundamental analysis, technical analysis, and risk management techniques. A comprehensive understanding of market drivers enables critical evaluation of signals, improved decision-making, and resilience against market adversities. Resources like economic calendars, sentiment analysis tools, and detailed trading guides can significantly enhance your skill set.

Always scrutinize signal providers: avoid those making exaggerated promises, refusing to disclose analytical methods, or lacking credible performance histories. Ethical trading involves transparency, accountability, and responsible use of signals—never blindly follow recommendations without understanding the rationale behind them.

Emerging Trends and Future Directions in Forex Signal Regulation

The rapid advancement of financial technology, including blockchain integration and AI-driven analysis, is shaping the future regulatory landscape. Governments and industry bodies are pushing for stronger licensing requirements, disclosure standards, and anti-fraud measures. Innovations such as blockchain-based audit trails are being explored to enhance transparency, allowing traders to verify provider credentials, performance data, and compliance records efficiently.

Furthermore, international efforts aim to harmonize standards across jurisdictions, establishing industry-wide best practices. Initiatives include mandatory licensing, periodic audits, and standardized disclosures regarding methodology, risk factors, and performance metrics. The integration of machine learning and AI in signal generation necessitates regulatory guidance around algorithmic transparency, fairness, and accountability.

For traders, staying informed about these evolving regulations and choosing regulated, transparent providers is paramount. Continual education about macroeconomic policies, geopolitical influences, and technical strategies will bolster decision-making resilience. Resources like this in-depth crypto market analysis offer valuable insights into broader market developments, supporting informed, compliant trading.

Conclusion: Safeguarding Your Trading Journey in the Forex Signal Space

The question “Are forex signals illegal?” does not lend itself to a simple yes or no. Their legality hinges on the provider’s compliance with regulatory standards, transparency, and the responsible manner in which traders utilize these signals. Reputable, regulated providers operate within legal frameworks and can be valuable tools when employed judiciously.

However, unregulated or deceptive operators often exploit regulatory gaps, engage in scams, and threaten traders’ financial security. To mitigate these risks, diligent verification of licensing, scrutinizing performance claims, and understanding the analytical basis for signals are essential. Integrating signals into a broader trading strategy that emphasizes education, risk management, and diversification fosters more sustainable success.

Remember, trading is a skill cultivated through continuous learning, disciplined execution, and ethical use of tools. Resources such as this comprehensive guide on funding fees and strategic trading can help you develop resilient, compliant trading habits—ensuring your trading journey remains within legal and ethical boundaries while aiming for consistent profitability.